GDP Growth Slows While Price Pressures Increase

Photo Credit: Saul Macias, Unsplash

Weekly Market Recap for April 26, 2024

This week’s initial estimates of 1Q24 GDP revealed a complex picture. At the start of the year, expectations were set for gradual declines in growth and inflation. However, the data showed a sharp deceleration in headline growth while inflation, as measured by the personal consumption expenditures price index (PCE), accelerated on a quarter-to-quarter basis. This has raised concerns about potential stagflation and its implications on interest rates and markets.

The consensus on Wall Street is that the central bank will hold the federal funds rate at 5.25%-5.50%. Lately, the view on the Street is that the Fed will cut rates in one or two 25-basis-point increments during the second half of 2024, most likely sometime after mid-year.

Performance through the remainder of this year will depend on broader economic growth, corporate earnings, consumer spending, the pace of inflation, and, of course, Fed rate policy.

S&P 500 Index (Last 12 Months)

S&P 500 Technical Composite (Last 24 Months)

Q1 2024 GDP Growth

In Q1 2024, U.S. GDP expanded at a +1.6% annual pace, a continued slowdown from the +3.4% and +4.9% paces during Q4 and Q3 2023, respectively. If the current estimate holds, it would end six consecutive quarters of +2% or higher GDP growth. The increase in real GDP during the quarter reflected increases in consumer spending, residential and nonresidential fixed investment, and state and local government spending, which were partly offset by a decrease in private inventory investment. Compared to Q4, the deceleration in real GDP during Q1 reflected a slowdown in consumer spending, nonresidential structure investment (i.e., commercial buildings, power, communication, etc.), exports, and government spending at the federal, state, and local levels. A look across categories shows significant noise during Q1, with the volatile net exports and change in inventories categories detracting from GDP growth. The less volatile GDP categories, including consumer spending, residential and nonresidential investment, and government spending, suggest that "core GDP" was a solid print despite slowing.

Contribution to 1Q24 Real GDP Growth (%q/q)

GDP Price Index

The Q1 GDP report added to recent evidence that suggests inflation is stickier and more persistent than expected. The GDP price index, like CPI, measures price changes across consumer, business, and government spending and rose by +3.1% during Q1. It was an increase from Q4's +1.6% reading. The increase was driven by rising consumer service prices (goods prices ticked lower), increasing prices for government expenditures (both federal and state/local), and rising import prices. The combination of slowing GDP growth and increasing GDP prices raised immediate concerns about the risk of stagflation, which in turn caused Treasury yields to move higher.

GDP Price Index Rises By +3.1% During Q1

May 2024 FOMC Meeting

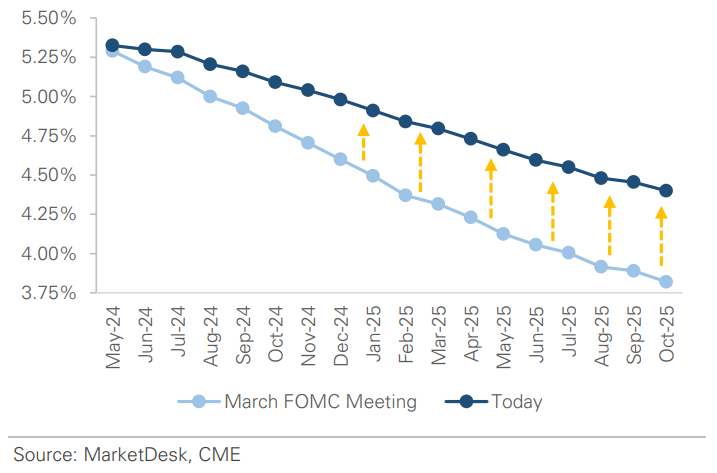

The Fed's May FOMC meeting occurs next Tuesday and Wednesday (4/30-5/1). The meeting will likely be uneventful, with the Fed expected to hold interest rates steady. While the macro backdrop has mostly been unchanged since the March meeting (i.e., slowing inflation progress and low unemployment), the market has experienced significant hawkish repricing. Investors now only expect one rate cut before the end of 2024, with that cut forecast in December. With rates expected to hold steady, the near-term policy change is QT tapering, which the Fed has hinted at in previous FOMC meeting minutes. The Fed has already shrunk its balance sheet by over $1.5 trillion, and officials now want to slow the pace of QT. While the Fed could continue at the current pace, we understand the concerns about QT creating a liquidity event like in 2019, when the central bank miscalculated the appropriate level of bank reserves. Slowing QT today means that the Fed can keep QT running at a slower pace for longer.

Fed Funds Futures Curve (Today vs March FOMC)

Quarterly Refunding Announcement (QRA)

Next week's second significant event is the Treasury's QRA, which takes place Monday (4/29). The QRA is when the Treasury announces how much debt it will issue and where that issuance will fall on the curve. The QRA has become more important recently due to concerns about a supply/demand mismatch for longer-duration Treasury bonds. The Treasury must finance its growing deficit, but investors are concerned about sticky inflation. As a refresher, the November QRA positively impacted risk assets as the Treasury announced plans to rely more on Treasury bill issuance than Treasury bond issuance. The S&P 500 gained ~+15% from November to the end of January, and the 10Y yield dropped from nearly 5.00% to under 4.00%. The January QRA marked a notable shift, with the Treasury increasing its issuance of longer-maturity Treasury notes and bonds. The S&P 500 gained another +7% through the end of March before trading lower by nearly -5% in April. In addition, the 10Y yield has risen from under 4.00% at the start of February to 4.70% this week. We will be watching next week's QRA closely to see whether the Treasury continues to issue a more significant proportion of Treasury notes and bonds, like in January, or relies on Treasury bills to give the market a reprieve, like in November.

Big Tech Earnings

Multiple big tech companies reported this week, and expectations played a role in how the market reacted. Meta (+42% YTD) faced a high bar heading into its earnings announcement, and while the company beat on sales and EPS, it traded down by -15% after reporting plans to increase its AI investment. The bar was lower for Microsoft (+7.6% YTD), which gained +5% after beating sales and EPS estimates due to strength in its cloud services. Google-parent Alphabet (+12.9% YTD) jumped +13.5% after beating sales and EPS estimates, initiating a dividend, and announcing a $70 billion buyback. Putting aside expectations heading into the earnings reports, the group delivered solid earnings.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.