Rising Treasury Yields Cause Stocks & Bonds to Trade Lower

Photo Credit: Carlos, Unsplash

Monthly Market Summary

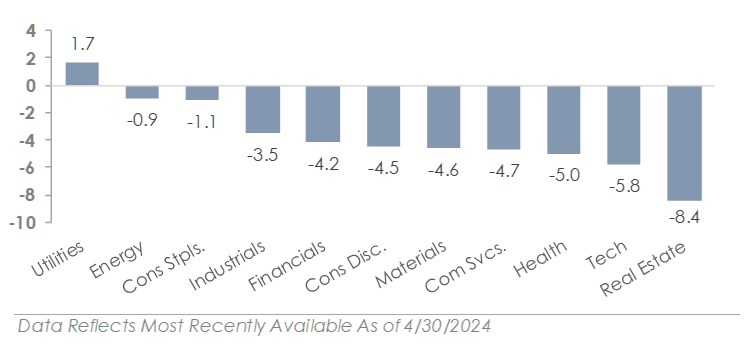

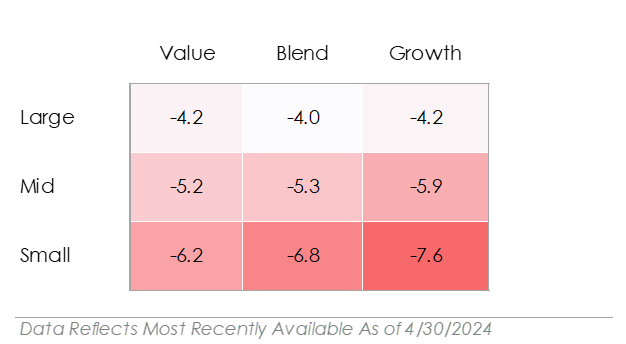

The S&P 500 Index returned -4.0%, outperforming the Russell 2000 Index’s -6.8% return. Ten of the eleven S&P 500 sectors traded lower in April, led by Real Estate.

Corporate investment-grade bonds produced a -3.2% total return as Treasury yields rose, while corporate high-yield bonds produced a -1.3% total return.

International stocks outperformed U.S. stocks. The MSCI EAFE developed market stock index returned -3.2%, while the MSCI Emerging Market Index returned -0.2%.

Stocks and Bonds Trade Lower as Treasury Yields Rise

The S&P 500 traded lower for the first time in six months. The magnitude of the sell-off was relatively small at -4.0%, but it ended the S&P 500’s 5-month rally. A rapid rise in Treasury yields contributed to the move lower in equities, with the 10-year yield rising +0.48% to end April at 4.68%. The Russell 2000 Index, more sensitive to interest rate movements, traded lower by -6.8% as rising interest rates weighed on smaller companies. In the credit market, bond prices declined as Treasury yields rose. As discussed below, the prospect of a first-half 2024 interest rate cut diminishes.

S&P 500 April Sector Returns in %

S&P 500 April Style Returns in %

An Update on This Year’s Biggest Market & Economic Trends

The S&P 500, despite trading lower in April, has gained +5.9% this year. Companies like Nvidia, Amazon, and Google-parent Alphabet account for a significant portion of the S&P 500’s gains. The three companies benefit from increasing investment in artificial intelligence, which drives demand for their data centers, cloud computing software, and semiconductors. In contrast, small-cap stocks are trading lower this year due to their sensitivity to higher rates. This is because smaller companies rely more on short-term financing and floating-rate debt, which causes their interest rates to reset faster.

The sharp rise in Treasury yields is one of the year’s biggest stories. At the start of 2024, investors expected the Federal Reserve to start cutting interest rates in March. It is now mid-May, and March passed without an interest rate cut. What is preventing the Fed from lowering rates? Inflation and employment data. Inflation progress is slowing, and unemployment is still below 4%. The low unemployment rate allows the Fed to focus more on reducing inflation. As a result, investors expect only one rate cut in 2024, down from six at the start of the year. Furthermore, the first cut is not expected until Q4.

Rising commodity prices are one reason that inflation remains sticky. Oil prices have risen +14.3% this year, leading to a +22.5% increase in gasoline prices. Copper, a barometer of economic activity due to its wide array of end uses, has gained +17.6%. Higher commodity prices hint at solid underlying demand, and economic data suggests the U.S. economy is adjusting to higher rates. New home sales reached a 6-month high in Q1, and consumers continued to spend despite higher rates. The U.S. economy’s resilience to higher rates is another reason the Fed is not rushing to cut rates.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.