US Debt Downgrade, Congress Debates Tax Cut Bill, and Fed Speakers Urge Patience

Photo Credit: David Everett, Unsplash

Weekly Market Recap for May 23rd

This week, stocks edged lower, with the S&P 500 declining less than -1%. Smaller companies underperformed, while the Nasdaq Index remained a relative outperformer. The Low Volatility, Growth, and Momentum factors were relative outperformers, while the Equal Weight and High Beta factors lagged. Defensive sectors slightly outperformed, while Energy and Real Estate led to the downside. The bond market saw the most notable development, as the U.S. debt downgrade and deficit-funded tax cut bill pushed Treasury yields higher. Long-duration Treasury and corporate bonds underperformed, while shorter-duration bond proxies were unaffected. Volatility picked up modestly, with both equity (VIX) and bond (MOVE) gauges rising after recent declines. Meanwhile, the U.S. dollar weakened amid growing fiscal concerns.

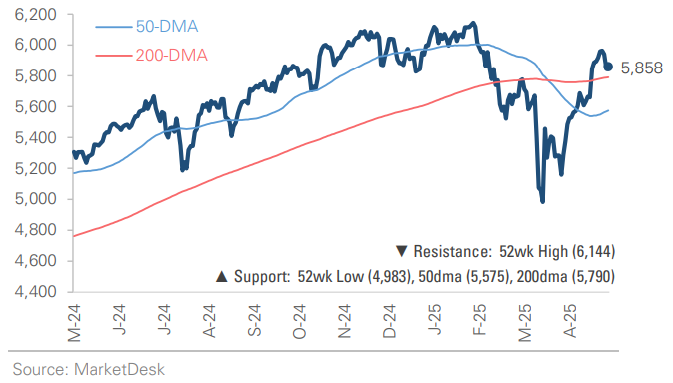

S&P 500 Index (Last 12 Months)

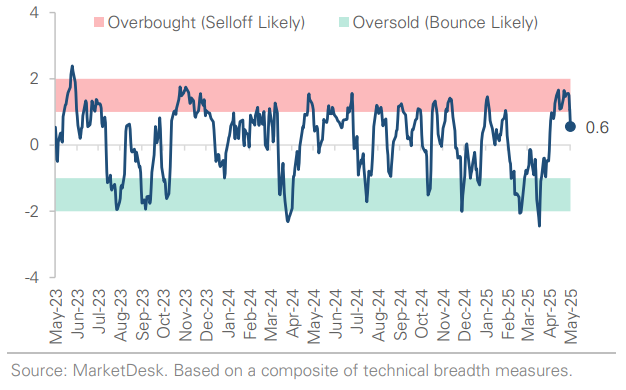

S&P 500 Technical Composite (Last 24 Months)

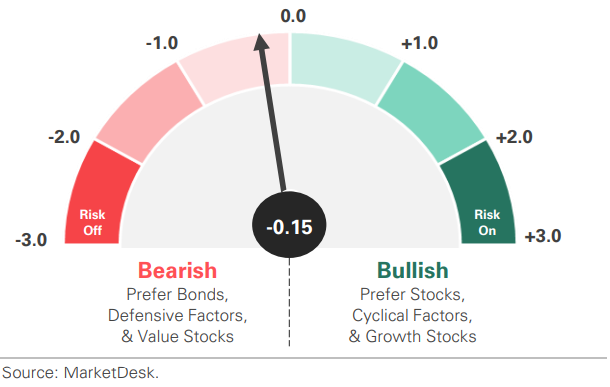

US Risk Demand Market Indicator

The US Risk Demand Indicator (USRDI) is a quantitative tool to measure real-time investor risk appetite. When the indicator is above zero, it signals a risk-on environment favoring cyclical sectors, high beta stocks, high-yield corporate bonds, and hybrid (convertible) bonds. In contrast, a reading below zero signals a risk-off environment favoring defensive sectors, low-volatility stocks, and U.S. Treasury bonds.

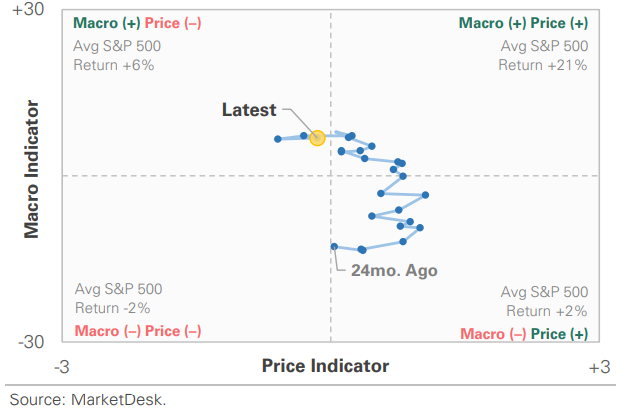

US Market Economic Cycle

The Market Cycle Indicator tracks two primary investor groups: macro investors and price-based investors. Macro investors rely on fundamental and economic data to guide their decisions, while price-based investors (or technical analysts) focus on price action, momentum, volume, and behavioral trends. The Indicator synthesizes these perspectives to identify the prevailing market regime.

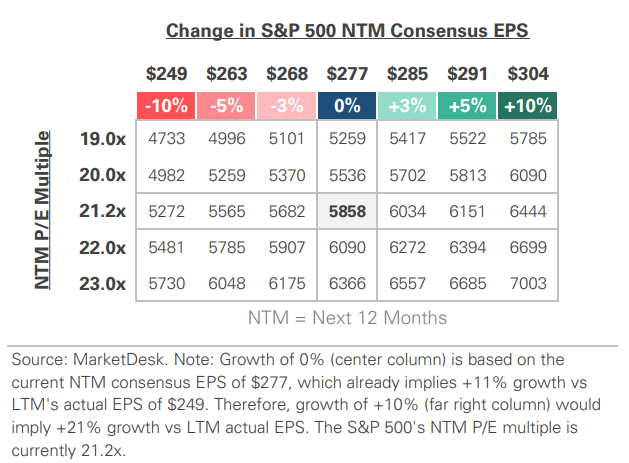

S&P 500 Valuation Matrix

Key Takeaways

#1 - Moody Downgrades US Credit Rating

Moody's downgraded the US credit rating by one notch, stripping the US of its last AAA rating among the three major credit agencies (S&P downgraded in 2011, Fitch in 2023). Moody's cited unsustainable fiscal deficits, rising interest expenses, and increasing national debt as reasons for the downgrade. It also pointed to political dysfunction, including repeated debt ceiling standoffs and a lack of a credible long-term fiscal plan.

Implication: The downgrade was not a surprise, but it comes amid mounting concerns about the country's fiscal health.

#2 - Trump Tax Bill Passes House

The downgrade comes as Congress debates the Trump administration’s tax cut bill, which seeks to extend the 2017 tax cuts. Supporters argue it could boost investment and economic growth, but estimates suggest it could add $3–5 trillion to the national debt over the next decade, raising concerns about fiscal responsibility.

Implication: The House passed its bill version, but its fate remains uncertain as some Republican senators push for significant changes.

#3 - Fed Signals Patience

Fed officials continue to signal a cautious and data-dependent approach to rate cuts. Several speakers this week emphasized the need for patience, citing ongoing policy uncertainty and inflation risks tied to tariffs. While rate cuts are still expected later this year, officials stressed that decisions will depend on incoming economic data.

Implication: Absent a significant economic shock, the Fed is now likely to keep interest rates unchanged over the summer months.

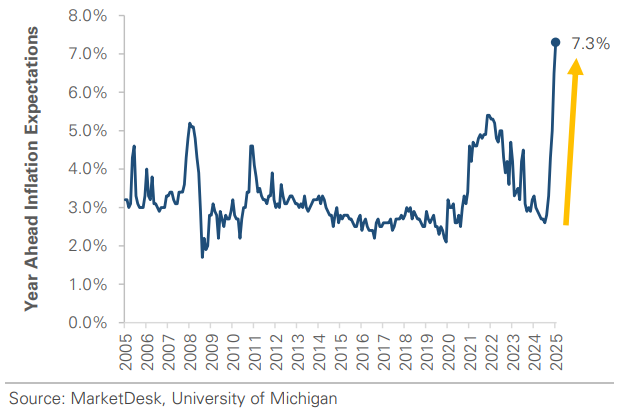

Year Ahead Inflation Expectations

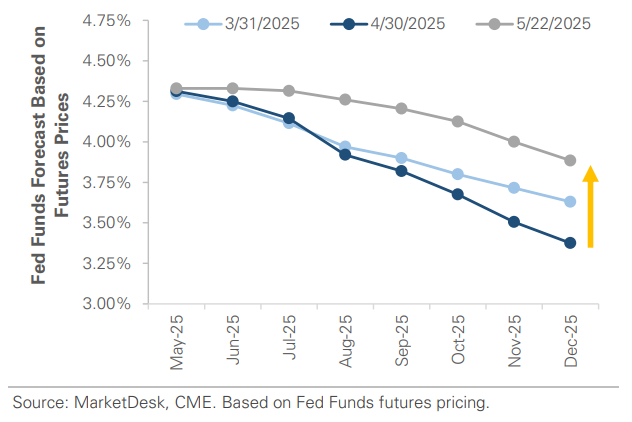

#4 - Rate Cut Expectations

Markets are scaling back rate cut expectations in response to the Fed's messaging. In the past three weeks, the number of projected cuts has dropped from four to two, and the anticipated timing of the first cut has shifted from June or July to September.

Implication: Forecasts for Fed policy will likely remain volatile as the market and the central bank navigate an uncertain macroeconomic and policy environment.

Fed Funds Forecast Based on Futures Prices

#5 - US Fiscal Concerns

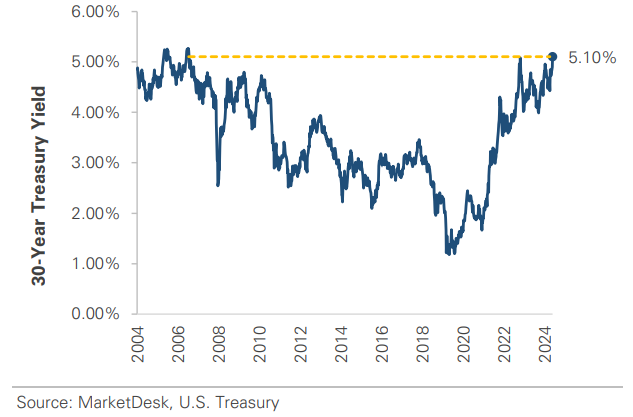

The combination of fiscal concerns and fewer rate cuts is weighing on long-duration Treasury bonds. The 30-year Treasury yield rose above 5% this week, touching levels last seen in early 2007. The catalyst: a lackluster auction of 20-year U.S. Treasury bonds.

Implication: Bonds face selling pressure as investors' sentiment turns deeply negative.

US 30-Treasury Yield

#6 - Rising Yields

It is important to distinguish why yields are rising. When yields rise due to stronger growth expectations, that is typically a positive signal. However, it is more worrisome when they rise due to policy and fiscal concerns. While tax cuts would boost growth, the market is instead focusing on the deficit.

Implication: Higher yields can impact markets in several ways: stocks can sell off as bonds become more attractive, and economic growth can slow as financial conditions tighten.

#7 - Market Rebound

Last week, we highlighted the unusual nature of the market rebound. The QQQ ETF has staged a COVID-like recovery, but one group has posted an even stronger rebound: meme stocks. Coreweave has gained +180% since its late-March IPO, when it struggled to attract investor interest, and Nvidia stepped in as an anchor investor. MicroStrategy, known for its Bitcoin holdings, is up +70%. Tesla has climbed +58% following Elon Musk’s return, Hims & Hers Health, a telehealth provider, has gained +112%, and Robinhood has rallied +88%. Even SPACs are back after earning a bad reputation in 2021-2022.

Implication: This is not a normal market.

US Meme Stocks

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.