Bonds Are Starting to Act Like Bonds Again

Photo Credit: Franz Roos, Unsplash

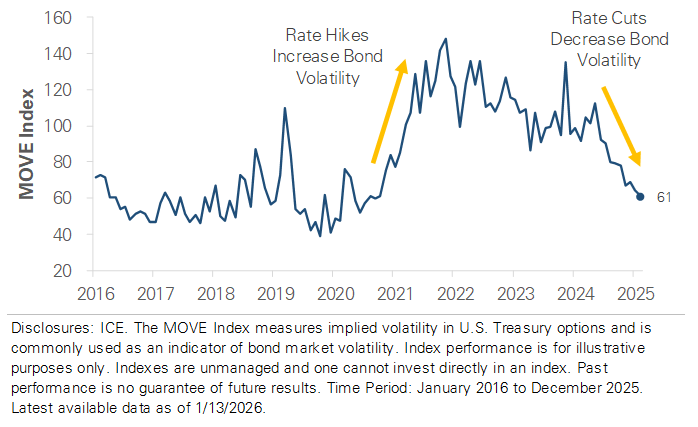

The bond market is emerging from a turbulent few years marked by shifting market conditions and increased volatility. The chart below shows the MOVE Index, a measure of volatility in the U.S. Treasury market. Like the more well-known VIX Index, higher readings signal expectations for more bond market volatility. The bond market was stable in the late 2010s, but when the pandemic struck in 2020, it became more volatile. The MOVE Index spiked above 100 as the pandemic and economic uncertainty made financial markets more volatile, but it quickly retreated as the Federal Reserve cut interest rates to near 0%. The bond market was significantly less volatile in 2021 as the economy reopened and the Fed held interest rates steady, though rising inflation and expectations of Fed rate hikes pushed volatility higher.

From early 2022 to mid-2023, the bond market was extremely volatile as the Fed raised interest rates by 5.25%, one of the fastest and steepest rate-hiking cycles in modern history. Bond market volatility, which was already rising due to soaring inflation and Fed policy uncertainty, remained high throughout the entire rate-hiking cycle. The MOVE Index climbed back above 100 and peaked near 150 in late 2022, with bonds behaving as a source of risk rather than diversification. However, since late 2022, bond market conditions have steadily improved. Inflation has cooled, the Fed has cut interest rates by -1.50%, and recession concerns have eased. The MOVE Index is in the low 60s, the lowest since 2021. While there have been periods of volatility around key economic data releases and Fed meetings, the path has been smoother.

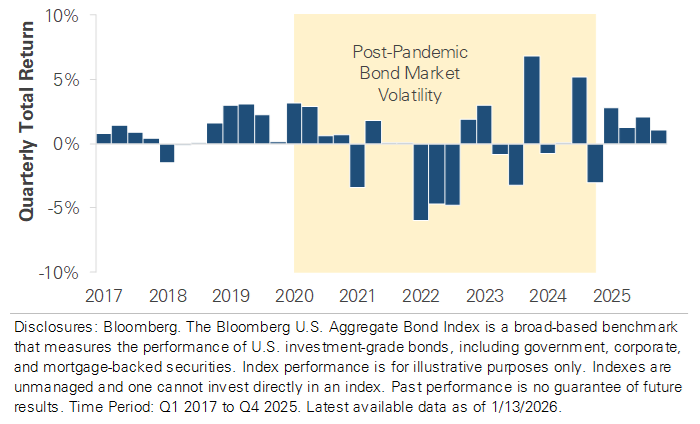

Bond market returns followed a similar pattern over the past five years. The second chart shows the quarterly total return of the Bloomberg U.S. Aggregate Bond Index, the standard benchmark for U.S. investment-grade bonds. The index generated positive returns in ten of the twelve quarters from 2017 to 2019, but its returns have been more volatile since 2020. It declined by 1.5% in 2021 and 13% in 2022 as inflation soared to a 40-year high and the Fed aggressively hiked rates, a rare sequence of negative back-to-back annual returns. The volatility and negative returns are consistent with the high MOVE Index. Bond market conditions stabilized in late 2023 and 2024, and in 2025, the bond market regained its footing. The Bond Aggregate produced a positive return in each quarter and gained +7.3% for the full year, its strongest year since 2020.

What does this mean for your portfolio?

The past few years have tested the role of fixed income in portfolios. Today, the combination of lower interest rate volatility and higher starting yields points toward a more familiar risk and return profile. Bonds could still experience volatility if inflation or policy expectations shift again, but they’re behaving more like an asset class that can provide a blend of diversification and income. As bond market conditions normalize, now may be a good time to revisit your fixed income allocation and ensure your portfolio remains aligned with your long-term goals.

Bond Market Volatility Continues to Decline

Bond Aggregate Index Quarterly Total Return (2017-2025)

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.