Consumers Are Optimistic About the Market, But Cautious on the Economy

Photo Credit: Roman Hnydin, Unsplash

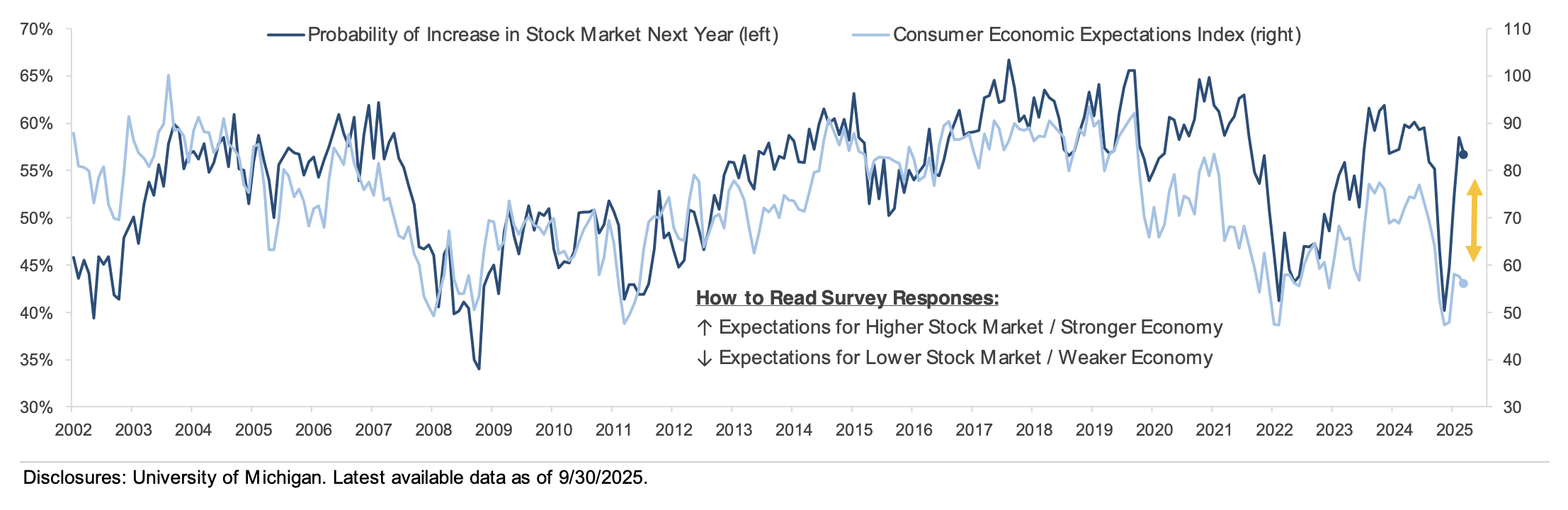

Recent consumer survey data has revealed a widening gap between how consumers view the stock market and the economy. The chart below shows a dark blue line tracking the percentage of consumers who believe the stock market will rise over the next year, while the light blue line shows the University of Michigan’s Consumer Expectations Index, which measures outlooks for income, employment, and overall economic conditions.

Historically, these two series move together: when consumers feel better about the economy, they feel better about the stock market. However, that relationship has broken down this year. Nearly 60% of consumers expect the stock market to rise, while the expectations index sits near levels from the pandemic and the 2008 financial crisis. The takeaway: confidence in the stock market has rebounded, but overall sentiment remains weak.

Consumers are increasingly optimistic about the stock market. The S&P 500 has set over 20 new all-time highs since the end of May, and investors expect more gains. Corporate earnings have proven resilient, and the artificial intelligence industry is driving both economic and earnings growth as hundreds of billions are invested in AI infrastructure. Trade policy uncertainty has eased from earlier this year, and the Federal Reserve’s September rate cut reinforced expectations for a “soft landing”, where the economy slows but avoids a recession. Many households have directly benefited from the market’s gains through investment and retirement accounts, boosting confidence despite mixed economic and labor market signals.

While consumers are confident in the stock market, they are cautious about the economy. Housing affordability remains a major concern, with elevated mortgage rates and high home prices. Inflation has moderated from its peak but continues to pressure household budgets, especially for essentials like food, healthcare, and rent. Meanwhile, the labor market has cooled after a post-pandemic surge, when demand for workers outpaced supply and companies raised wages. Job growth has slowed, job openings have declined, and unemployment has risen, leaving some workers less certain about future income and employment prospects. The result is growing unease about household finances, despite record stock prices.

It is rare to see such a wide gap between consumers’ views of the stock market and the broader economy. The divergence highlights a key tension: confidence in markets is rising, but many households continue to feel pressure from housing costs, inflation, and labor market uncertainty. The gap matters because the consumer accounts for roughly 70% of all U.S. economic activity. If sentiment remains weak, it could begin to weigh on consumer spending, which has supported economic growth, and the optimism that’s powered the stock market to new highs.

US Consumer Confidence in the Stock Market Diverges from Broader Economic Expectations

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.