Trade War Whiplash, Bank Earnings, Fed Policy, and Weakening AI Sentiment

Photo Credit: Priscilla Du Preez, Unsplash

Weekly Market Recap for October 17th

This week, markets declined as renewed US–China trade tensions and the government shutdown weighed on sentiment. The S&P 500 and the NASDAQ finished lower, giving back gains from earlier in the month, while small caps ended the week flat. Defensive sectors outperformed as market volatility increased, while financials led to the downside due to rising concern over commercial-loan exposures. International stocks outperformed the S&P 500 as the U.S. dollar weakened. In the bond market, Treasury yields fell as the market priced in additional rate cuts, with the 10-year Treasury yield near its lowest levels this year. Longer-maturity bonds outperformed, and high-yield corporate bonds underperformed investment grade. Gold surged to a new high, while crude oil fell over -6% to early 2021 levels.

S&P 500 Index (Last 12 Months)

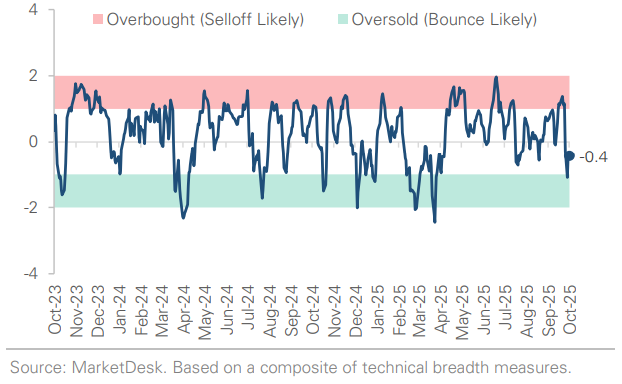

S&P 500 Technical Composite (Last 24 Months)

US Risk Demand Market Indicator

The US Risk Demand Indicator (USRDI) is a quantitative tool to measure real-time investor risk appetite. When the indicator is above zero, it signals a risk-on environment favoring cyclical sectors, high beta stocks, high-yield corporate bonds, and hybrid (convertible) bonds. In contrast, a reading below zero signals a risk-off environment favoring defensive sectors, low-volatility stocks, and US Treasury bonds.

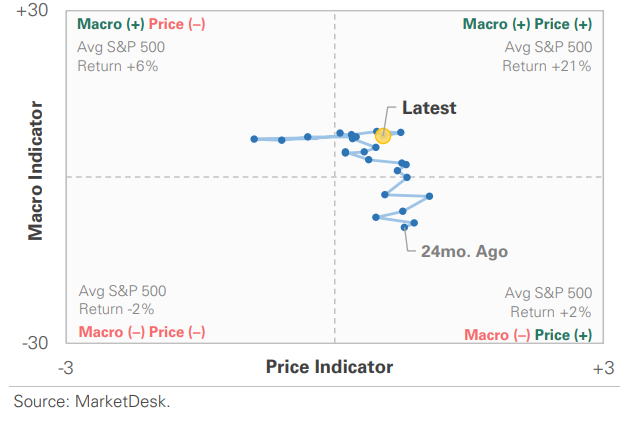

US Market Economic Cycle Indicator

The Market Cycle Indicator tracks two primary investor groups: macro investors and price-based investors. Macro investors rely on fundamental and economic data to guide their decisions, while price-based investors (or technical analysts) focus on price action, momentum, volume, and behavioral trends. The Indicator synthesizes these perspectives to identify the prevailing market regime.

S&P 500 Valuation Matrix

S&P 500 Forward PE Ratio

The S&P 500 forward price-to-earnings (P/E) ratio is a widely followed valuation metric that compares the index's current level to the projected earnings of its constituent companies over the next 12 months. The indicator implies to investors how much they are paying today for each dollar of expected future earnings.

Key Takeaways

#1 - Trade-War Whiplash

Investors experienced another round of trade-war whiplash this week. President Trump surprised the market by threatening across-the-board 100% tariffs on all Chinese imports, citing retaliation for Beijing’s new rare-earth export controls. The headline caused the S&P 500 to fall more than -2.5% the next day, its steepest drop since April, and sparked a rotation to Treasuries and gold.

Implication: The size and immediacy of the tariffs (Nov. 1 effective date) caught investors off guard and served as a reminder of how quickly policy can change.

Trade War Whiplash Creates Market Volatility

Small Cap Stocks Set a New Record High

#2 - Shift in US Tone

The market recovered some of its losses early in the week after a shift in tone from U.S. officials calmed investor nerves. President Trump posted that “it will all be fine,” while Treasury Secretary Scott Bessent confirmed a Trump-Xi sideline meeting would take place at the APEC summit in late October.

Implication: The de-escalation gave investors something positive to trade on, but until there’s definitive progress, the market is likely to remain highly sensitive to tariff headlines.

#3 - Consumer Sentiment

Consumer sentiment remains weak, but consumer behavior and bank executives tell a different story. The University of Michigan's Consumer Sentiment Index held steady near 55 in October, among the lowest levels in decades. While the survey points to weak consumer sentiment, the first wave of bank earnings points to consumer resilience. Multiple lenders, including JPMorgan Chase, Wells Fargo, and Citi, reported stable spending, solid credit quality, and healthy small business trends. Executives described consumers as financially strong, with delinquency rates steady or better than expected and spending holding up despite higher prices and borrowing costs.

Implication: Consumers may feel gloomy, but their actions tell a different story.

Consumer Sentiment Remains Weak

#4 - Next Fed Meeting is October 30th

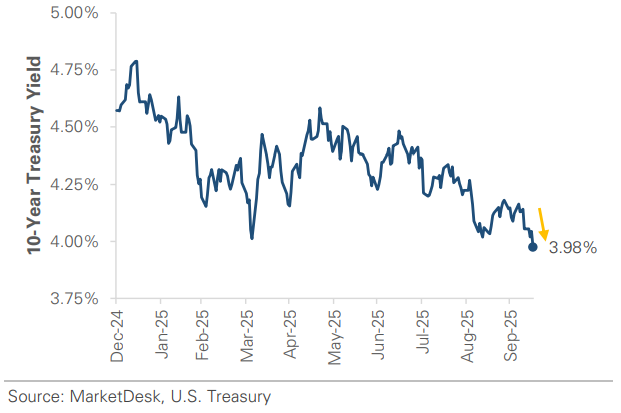

Fed officials delivered their final remarks before the blackout period ahead of the October 30th meeting. The broader message: the Fed remains committed to cutting rates and providing support as the economy cools, but officials are wary of cutting too aggressively without fresh data due to the government shutdown. In his speech, Fed Chair Powell said the labor market has demonstrated significant downside risks, signaling a second consecutive rate cut at the upcoming October meeting.

Implication: Fed officials continue to hint at additional cuts, with the market pricing in two additional 0.25% rate cuts by year-end.

10-Year Treasury Yield Sits Near 2025 Lows

Gold Continues to Surge Higher

Oil Falls to Lowest Levels Since Early 2021

#5 - AI Remains Dominant Theme

AI remained a dominant market theme this week. ChatGPT parent OpenAI announced deals with two semiconductor companies to design and manufacture its own computer chips, underscoring the continued surge in AI-infrastructure spending. However, sentiment around the AI trade is showing cracks. A survey of global fund managers found that over half of investors believe AI stocks are in a bubble, a significant shift from earlier in the year.

Implication: While AI continues to drive market leadership and corporate investment, concerns about valuations and profitability suggest investor enthusiasm is becoming more cautious and selective

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.