Markets Digest the Path of Interest Rates and the Next Phase of the AI Cycle

Photo Credit: Oleksandr Brovko, Unsplash

Monthly Market Summary

The S&P 500 Index returned +0.2% in November, its seventh consecutive monthly gain. Large Cap Growth declined -1.8% as AI-related names came under pressure, while Large Cap Value rose +2.7%. The Russell 2000 and the Dow Jones Industrial Average both outperformed the S&P 500, as mega-cap tech stocks weighed on the index.

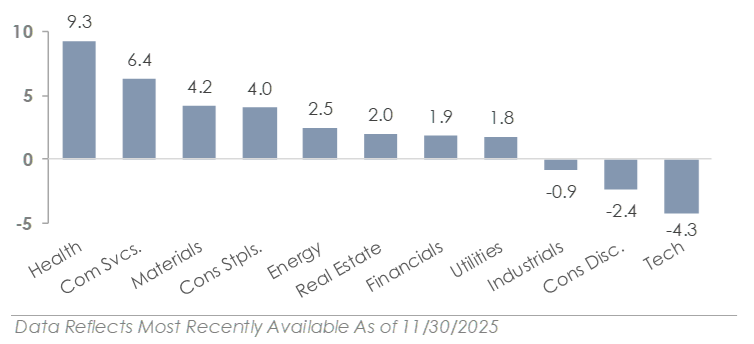

Health Care led all S&P 500 sectors with a +9.3% return. Eight of the eleven S&P 500 sectors outperformed the index, while the Technology, Consumer Discretionary, and Industrials sectors each traded lower and underperformed the index.

Bonds traded higher as Treasury yields ended the month lower despite intra-month volatility tied to uncertainty around a December rate cut. The U.S. Bond Aggregate gained +0.6%, increasing its year-to-date return to +7.5%. Investment-grade bonds matched the Aggregate’s +0.6% total return, edging out high-yield’s +0.5% gain.

International stocks were mixed. Developed Markets gained +0.6%, modestly outperforming the S&P 500, while Emerging Markets fell -2.4%. Year-to-date, both regions are outperforming the S&P 500 by more than +10%.

The Market's Tug-of-War with the Federal Reserve

The stock market was volatile in November as the Federal Reserve managed investor expectations for a December rate cut. The volatility started after the Fed’s late-October meeting, when Chair Powell said a December rate cut was “not a foregone conclusion.” Market-implied odds for a third consecutive rate cut fell from 98% in late October to around 40% in mid-November, as multiple Fed officials questioned the need for another rate cut. The uncertainty weighed on the stock market, with the S&P 500 trading lower and eventually bottoming on November 20th. Sentiment then shifted again late in the month as comments from influential Fed members, rising unemployment, and favorable inflation data pushed the odds of a December cut back above 80%.

The market’s reaction wasn’t just about a -0.25% rate cut, but rather what the Fed’s decision signaled about the future. A December cut would affirm the bullish narrative that the Fed was pulling off a “soft landing,” whereby the central bank proactively lowers interest rates to reduce the risk of recession. When the odds of a December cut initially fell, the market sold off as investors reassessed that optimistic outlook. Leaving rates unchanged would keep financial conditions tighter for longer, potentially slowing the economy and earnings growth. The late-month rebound, fueled by rising expectations of a December cut, reflected increased clarity and confidence about the path ahead.

The AI Trade Moves to the Next Phase as Investors Become More Selective

Stocks ended October near all-time highs after they staged a late-month recovery. Credit concerns surfaced early in the month after multiple regional banks disclosed losses tied to commercial real estate fraud. The news came only weeks after two high-profile bankruptcies in the auto sector, reigniting concerns about credit quality. Stocks initially sold off, but by month-end, concerns eased as credit rating agencies and analysts characterized the issues as isolated rather than systemic.

Around the same time, a sudden re-escalation of US–China trade tensions rattled the market just weeks before a high-stakes Trump-Xi summit. It began when China expanded export restrictions on rare earth minerals, prompting the White House to threaten a 100% tariff on all Chinese imports if Beijing didn’t reverse course. The threats sparked a stock market sell-off and revived fears of a trade war. However, despite the harsh rhetoric and threats, both sides left room for negotiation. The Trump-Xi summit took place as scheduled in late October, and the meeting yielded several headline agreements that helped ease near-term US-China trade tensions.

Market Sentiment: Cautious Optimism Ahead of Year-End

Artificial intelligence remains a key market driver with 7 of the 10 largest S&P 500 companies, or nearly 30% of the index, tied to the AI industry. In November, investor sentiment toward AI stocks shifted from broad enthusiasm to increased scrutiny and selectivity. The month began with concerns over the expensive valuations of the Magnificent 7 tech giants, particularly those most reliant on the AI infrastructure buildout. Questions emerged about whether the massive capital spending on data centers and cloud infrastructure will translate into profits strong enough to justify the companies’ high valuations. This skepticism about AI’s economics led to a sell-off across the AI industry, with companies like Nvidia and Amazon down by over 10% at times. Given the S&P 500’s extreme concentration in mega-cap technology stocks, the sector’s weakness was a major drag on the index.

The AI investment cycle is maturing, with investors’ focus shifting from pure infrastructure spending to real-world application and monetization. Signs of AI fatigue have emerged as investors weigh the steep upfront costs against uncertain long-term economics and productivity gains. One example is Oracle, which has fallen nearly 40% since September due to concerns about its aggressive debt-funded data center expansion, highlighting the growing cost anxiety. While AI remains a central theme in most 2026 market outlooks, investors are becoming more selective toward AI stocks, looking for tangible evidence of revenue growth and productivity improvements across the broader economy.

US Market Sector Returns (November in %)

US Market Sector Returns (YTD in %)

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.