Why Two Identical Salaries Can Lead to Very Different Retirement Lifestyles

Photo Credit: Link Hoang, Unsplash

Many people spend their careers focused on reaching the next salary milestone or securing a promotion, but financial progress should not be measured by your paycheck alone. The decisions you make in your peak earning years are just as important as the size of your paycheck. One of the most significant risks is lifestyle creep, which is the tendency for everyday spending to rise alongside income. How you manage a salary raise today can significantly impact your long-term financial security. Without a strategy for handling salary increases, even a high-earning household can find itself ill-prepared for the future.

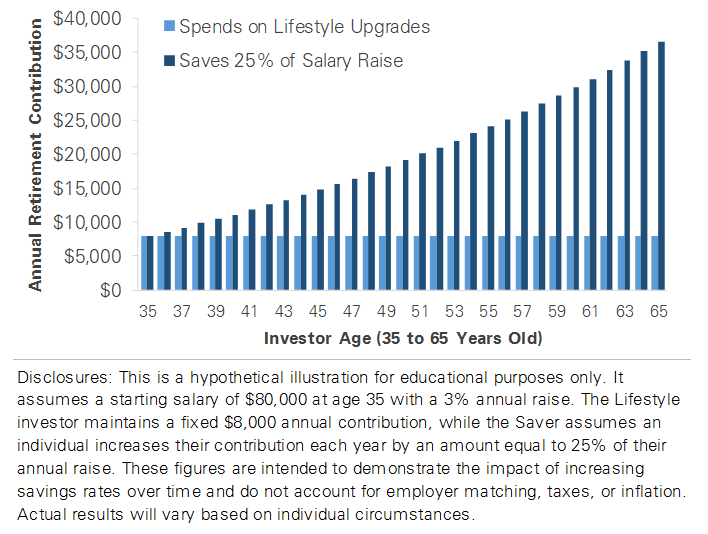

The charts below demonstrate how different approaches to salary increases can affect a retirement portfolio’s growth. They’re based on a hypothetical scenario: two individuals aged 35 make $80,000 annually and receive 3% annual raises. Both start by contributing 10% of their salary, or $8,000, to retirement savings. The two sets of bars in Figure 1 track different strategies for managing the raises and retirement contributions. The Lifestyle individual keeps their annual contribution fixed at $8,000. Every dollar of every raise is spent on immediate lifestyle upgrades, such as a nicer car, another trip, or higher discretionary spending. The Saver individual takes a more balanced approach, setting aside 25% of every raise while enjoying the rest. For example, a $2,000 increase would raise next year’s contribution by $500, or by 25%.

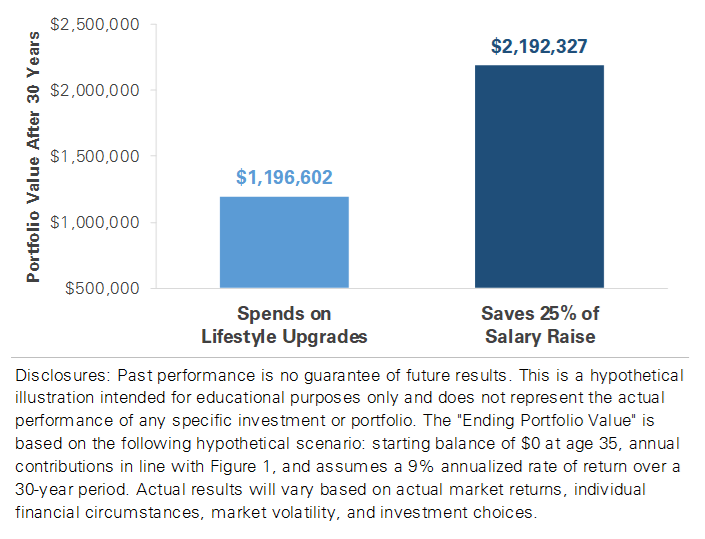

Although both individuals earn the same amount, their retirement savings diverge rapidly. The second chart graphs the ending portfolio values at age 65, reflecting 30 years of each individual’s savings strategy. These hypothetical ending account values assume the portfolios earn a +9% annual return. Over 30 years, the Lifestyle individual contributed nearly $250,000, which grew to nearly $1.2 million. The Saver individual contributed nearly $630,000, which grew to nearly $2.2 million, almost $1,00,000 larger than their peer’s. The difference is not just additional savings, but decades of compounding that can extend a portfolio’s life in retirement or create the option to retire earlier. In contrast, the Lifestyle individual not only saves less but also increases their base cost of living, which will require a larger portfolio to sustain their lifestyle in retirement.

Building long-term wealth is not just about what you earn, but how you manage the surplus as you earn it. Raises can either be absorbed by lifestyle upgrades or serve as a powerful tool for future security and flexibility. It is about finding a balance between enjoying the reward of hard work today and saving for your future. There is no one-size-fits-all approach, and the method you start with doesn’t have to be permanent. Everyone’s retirement looks different, and the right strategy depends on your goals and life stage. Our goal is to help you create a savings strategy tailored to your unique needs and goals so that when the time comes, you’re ready to enjoy retirement.

Annual Retirement Contribution By Savings Strategy

Ending Portfolio Value Based on Savings Strategy

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.