Portfolio Allocation Drift: Is It Time to Rebalance Small Cap Exposure?

Photo Credit: Roman, Unsplash

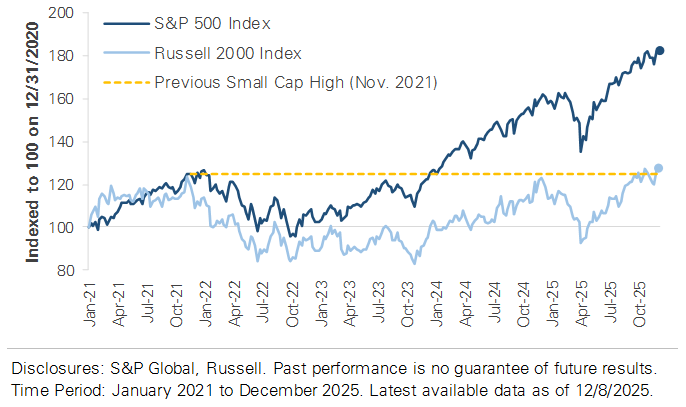

The S&P 500 has delivered strong returns over the past two years, setting 57 all-time highs in 2024 and adding more than 35 in 2025. Large-cap stocks have benefited from a combination of AI enthusiasm, resilient earnings, and strong economic growth. However, one corner of the market has been noticeably absent: small-cap stocks. While the S&P 500 climbed to new highs, the chart below shows the Russell 2000, an index of small-cap stocks, remained stuck below its November 2021 peak. The four-year drought ended this fall when small caps broke through to new highs, driven by expectations for additional Federal Reserve rate cuts.

Small-cap stocks are more sensitive to interest rates than their large-cap counterparts. Many smaller companies carry higher debt loads relative to their size and rely more heavily on borrowing to fund growth. When interest rates rise, financing costs squeeze profit margins. Conversely, when interest rates fall, the pressure eases as borrowing becomes cheaper. Small’s recent underperformance began when the Federal Reserve started its rate-hiking cycle in 2022, but it began to reverse in Q3 this year. Expectations for additional rate cuts have breathed new life into small caps. Small-cap stocks gained +12% in Q3 compared to +7.8% for large caps, the largest relative outperformance since Q1 2021. The outperformance has continued into Q4, with small caps outperforming large caps by +1.0% quarter-to-date.

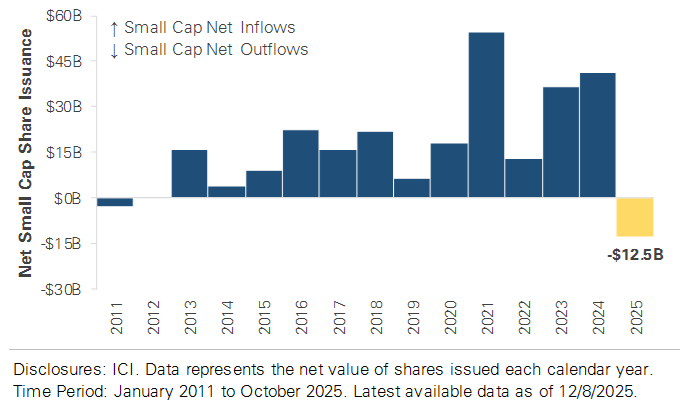

Beyond the Fed's actions, valuations and investor flows tell a compelling story. Small-cap stocks trade at a significant discount to large caps, with the valuation gap at extremes. The chart below shows that small-cap ETFs have posted net outflows this year, shedding roughly $12.5 billion through October 2025. It’s the first year of net outflows since 2011. The message is clear: small-cap stocks haven't just underperformed; they've been actively avoided. Investors poured money into large-cap tech and AI-related names while small caps were left behind. The combination of depressed valuations and persistent outflows suggests these stocks are not just undervalued but genuinely unloved and underowned. This creates a potential opportunity for long-term investors.

What does this mean for your portfolio?

If you have benefited from the S&P 500's record run, the small-cap breakout raises a strategic question: Is it time to rebalance? The goal isn't to time the market but to evaluate whether your portfolio has drifted too far toward large caps and whether adding small-cap exposure aligns with your long-term goals. Small caps bring diversification at a time when the S&P 500 is highly concentrated in a few mega-cap tech names. Small caps are more domestically focused, spread across a wider range of industries, and less dependent on the AI narrative. While they are more volatile than large caps, the investment case appears to be strengthening. Fed rate cuts favor smaller borrowers, small caps trade at a steep valuation discount, and investor positioning is light. The recent breakout to new highs could mark a turning point. For those with a long-term horizon, small caps might deserve consideration in 2026.

Small Cap Stocks Surpass Previous 2021s Highs

Small Cap ETFs Experience Outflows in 2025

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.