More AI Deals, Government Shutdown Continues, and Gold Sets a Record High

Photo Credit: Kathyryn Tripp, Unsplash

Weekly Market Recap for October 10th

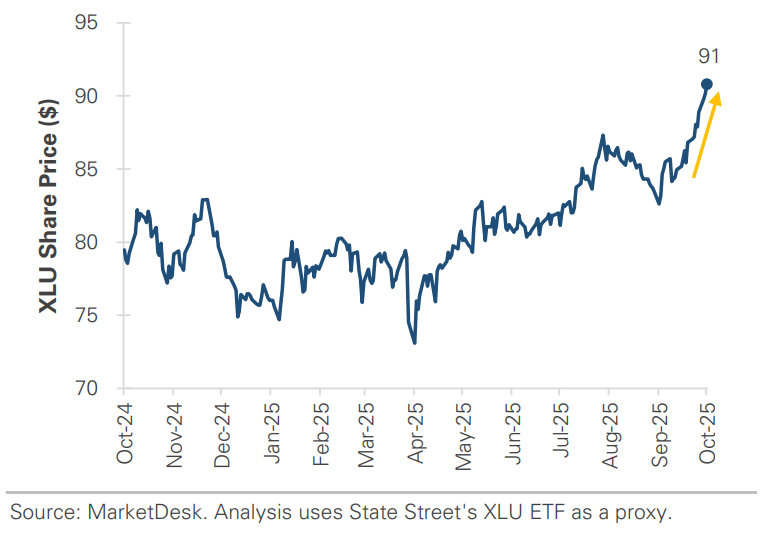

This week, markets continued to grind higher, extending their early October rally as investor optimism held firm despite the ongoing government shutdown. The S&P 500 hit another record high but mostly traded sideways, led by the Utilities and Technology sectors, which continue to benefit from AI investment. Small-cap stocks traded higher and modestly outperformed, but the group’s outperformance narrowed from recent weeks. Outside the U.S., international stocks underperformed the S&P 500 as the U.S. dollar strengthened. In the credit market, bonds traded lower as Treasury yields increased with the government shutdown. Meanwhile, gold and bitcoin set record highs, and the VIX drifted up toward a 3-month high but remained range-bound, signaling expectations for market volatility to remain subdued.

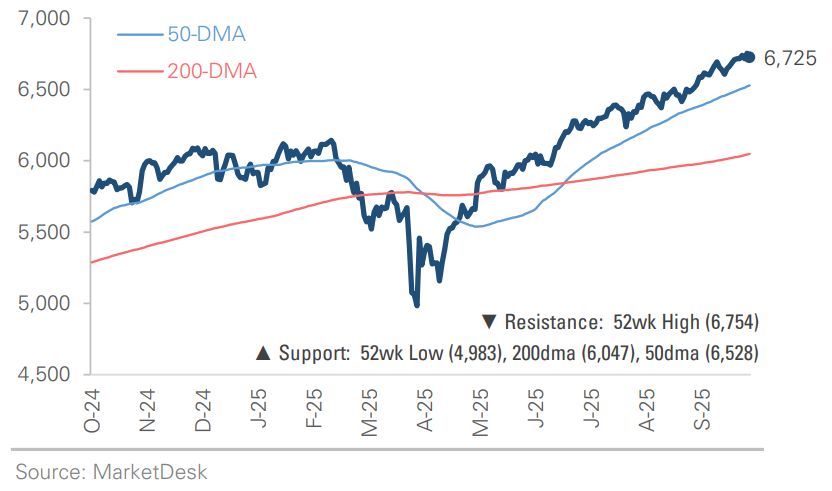

S&P 500 Index (Last 12 Months)

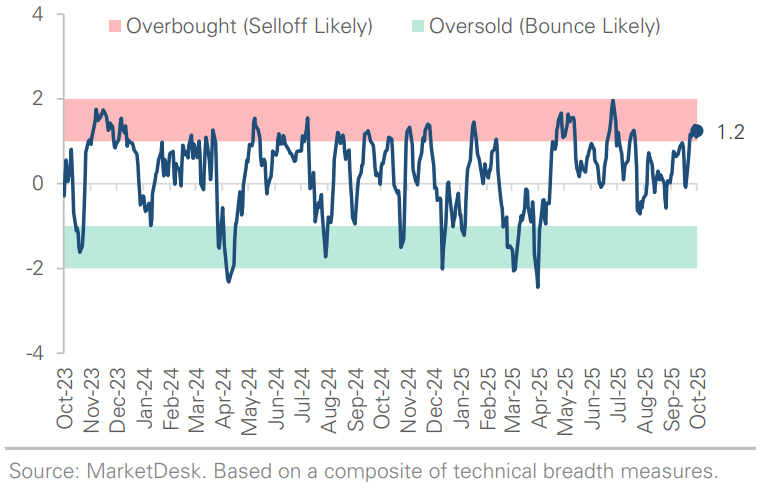

S&P 500 Technical Composite (Last 24 Months)

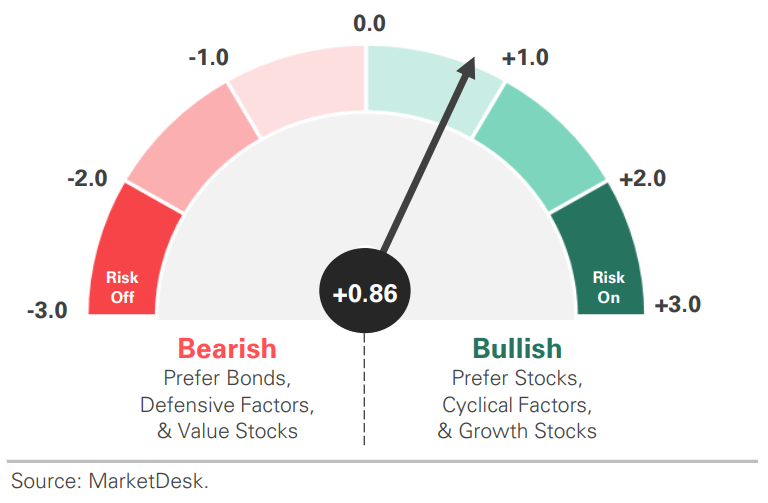

US Risk Demand Market Indicator

The US Risk Demand Indicator (USRDI) is a quantitative tool to measure real-time investor risk appetite. When the indicator is above zero, it signals a risk-on environment favoring cyclical sectors, high beta stocks, high-yield corporate bonds, and hybrid (convertible) bonds. In contrast, a reading below zero signals a risk-off environment favoring defensive sectors, low-volatility stocks, and US Treasury bonds.

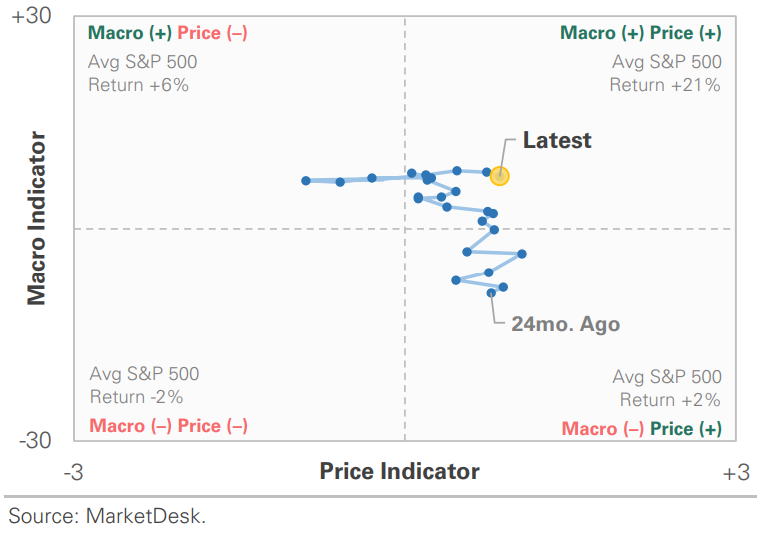

US Market Economic Cycle Indicator

The Market Cycle Indicator tracks two primary investor groups: macro investors and price-based investors. Macro investors rely on fundamental and economic data to guide their decisions, while price-based investors (or technical analysts) focus on price action, momentum, volume, and behavioral trends. The Indicator synthesizes these perspectives to identify the prevailing market regime.

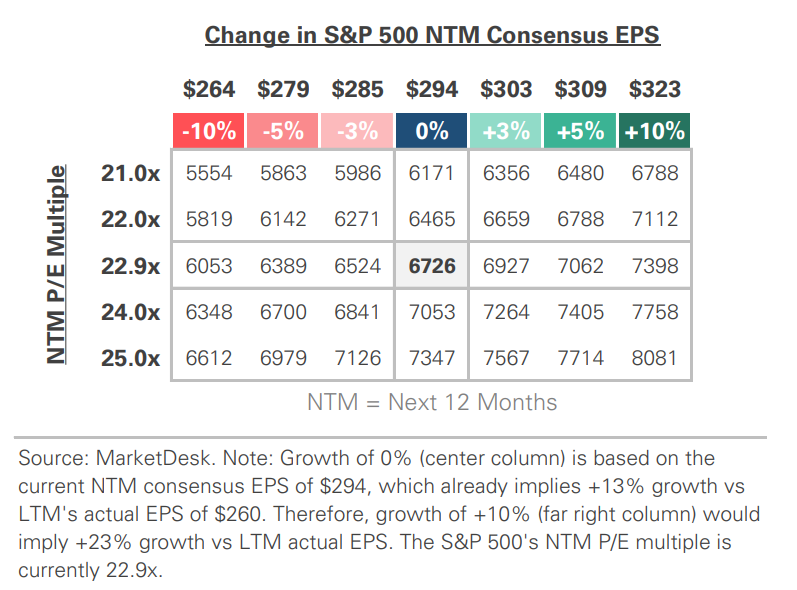

S&P 500 Valuation Matrix

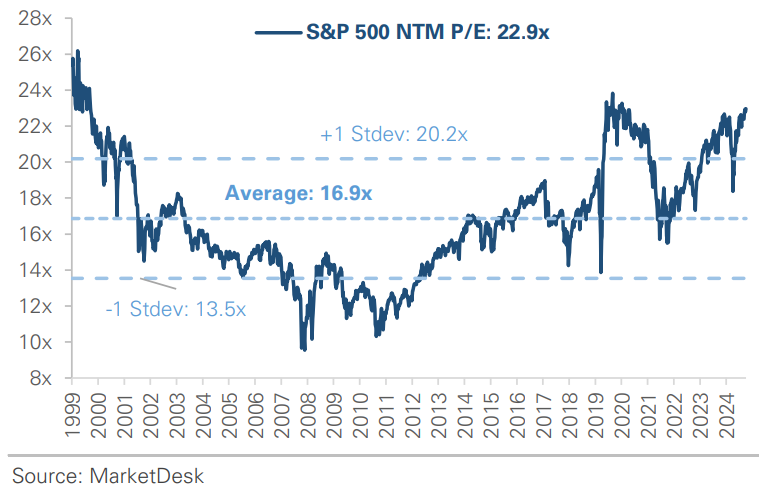

S&P 500 Forward PE Ratio

The S&P 500 forward price-to-earnings (P/E) ratio is a widely followed valuation metric that compares the index's current level to the projected earnings of its constituent companies over the next 12 months. The indicator implies to investors how much they are paying today for each dollar of expected future earnings.

Key Takeaways

#1 - Another Wave of AI-Related Deals

OpenAI announced a partnership with semiconductor company AMD, Nvidia invested $2 billion in Elon Musk's xAI, and IBM said it would integrate Anthropic's AI model Claude into its software. The partnerships build on the existing optimism around data center buildouts, but they also reignited debate about whether AI spending is creating a late-cycle bubble that echoes the late 1990s.

Implication: Investors continue to reward any connection to AI infrastructure or adoption. The upcoming Q3 earnings season will be a key test of whether AI-driven spending translates into real, durable profits.

#2 - Federal Shutdown Continues

The federal shutdown entered its second week, with little progress toward reopening the government. The market continues to shrug off the shutdown as a political sideshow rather than an economic shock. Still, the longer it lasts, the more it will start to impact investor and consumer sentiment. The prevailing view is that it is politically messy but economically manageable.

Implication: Investors have learned to treat shutdowns as noise. However, that patience will wear thin if the standoff drags on and the impacts are felt more broadly, such as missed paychecks and air travel delays.

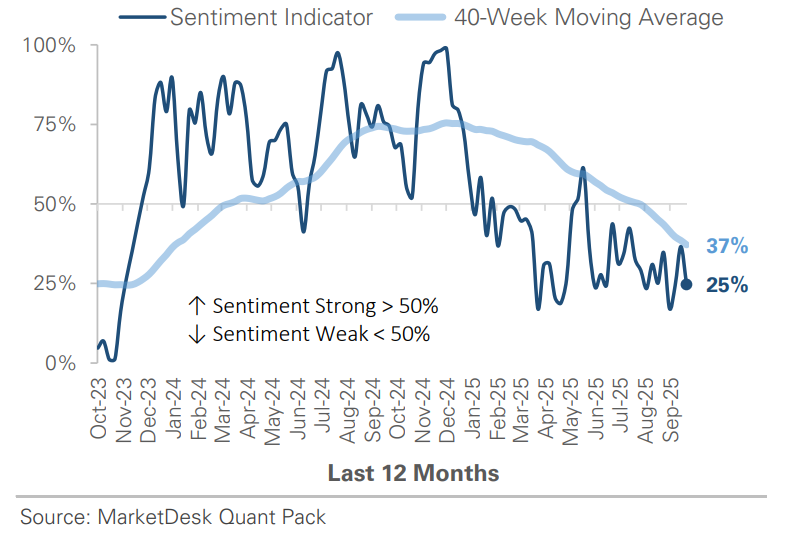

Investor Sentiment Remains Cautious

#3 - Government Shutdown Reduces Economic Visibility

The government shutdown has created an economic data blackout, reducing economic visibility for the market and the Federal Reserve, which meets the last week of October. Fed officials continue to emphasize a data-dependent approach, but the central bank is not getting the full picture without the latest labor market and inflation data.

Implication: The absence of fresh economic data hasn't been an issue so far, with the lack of new data helping to dampen market volatility. Investors rely on non-government and private sources for alternative data, but volatility could return once the shutdown ends and the market analyzes delayed data.

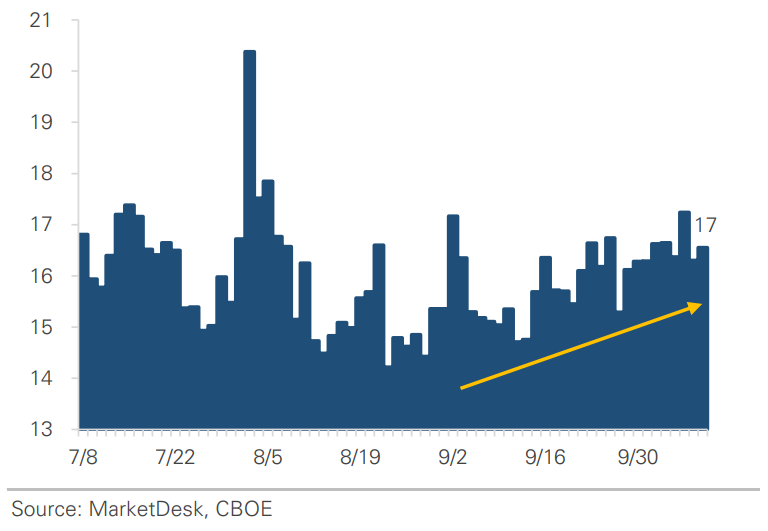

VIX Drifts Higher But Remains Subdued

#4 - Asset Classes Setting New Highs

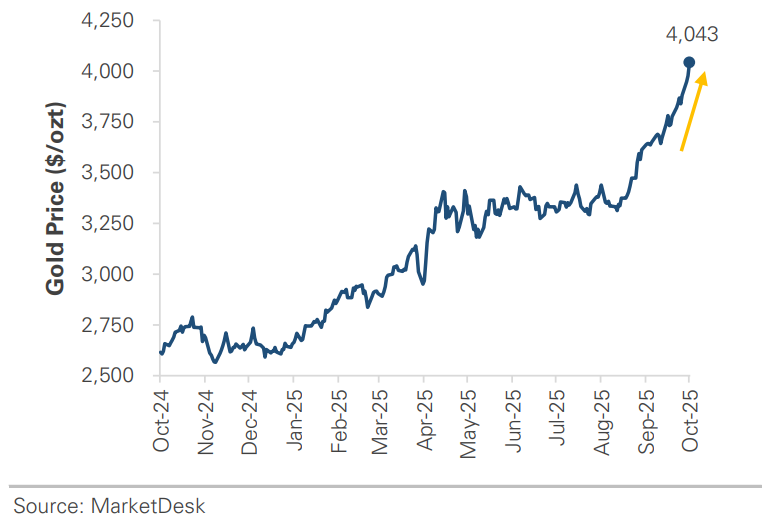

Stocks are not the only asset class setting new highs. Gold surged above $4,000 an ounce this week, bringing its year-to-date gain to more than +50%. The precious metal benefits from a combination of themes, including the government shutdown, expectations for more rate cuts, and economic uncertainty.

Implication: Gold’s breakout summarizes the current macro mood: the market expects the Fed to cut interest rates at its next three meetings. However, there is also uncertainty about the broader economy, and the shutdown is delaying economic data releases.

Gold Sets a Record High

Utility Sector Trades Near All-Time High

#5 - AI Infrastructure Spending Keeps Climbing

Multiple AI deals and partnerships were announced this week. CoreWeave announced a $14 billion agreement with Meta to provide computing power, while several Asian semiconductor firms signed contracts to supply chips for OpenAI’s Stargate data center.

Implication: These deals reinforce expectations that big tech companies will continue to drive capex spending across the AI supply chain in the coming years.

Rare Earths Stock as China Tightens Global Supplies

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.