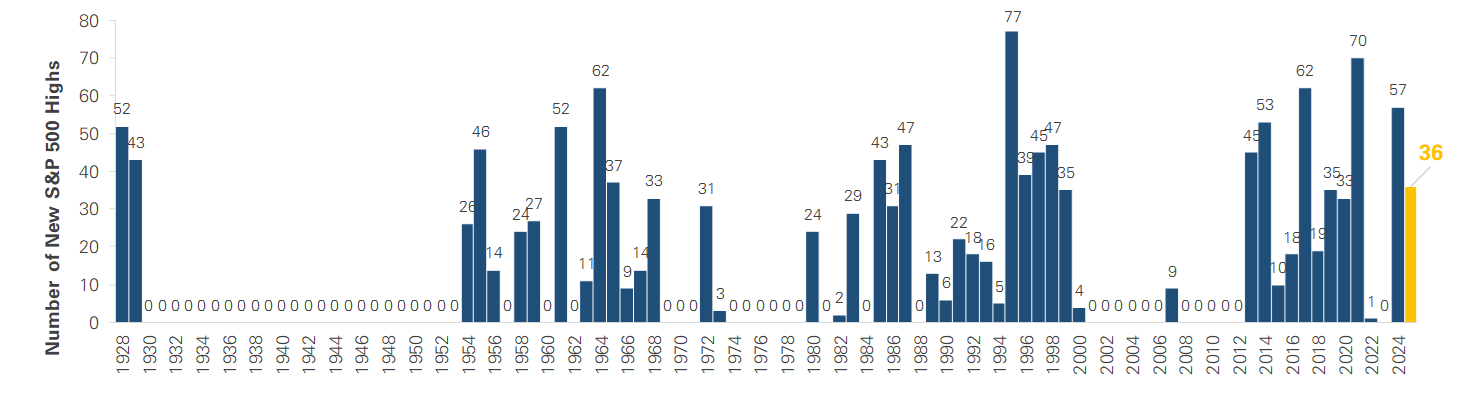

SP 500 Sets More Than 35 New Highs for Second Consecutive Year

Photo Credit: Laura Adai, Unsplash

The stock market is having another record-setting year. The chart below shows that the S&P 500 has set 36 new highs since the start of the year. While it’s a decline from last year’s pace, the number of new highs in 2025 ranks 18th compared to the past 98 years. The S&P 500’s strong performance this year is part of a broader equity market trend, with multiple other major equity indices also setting new highs. The Nasdaq has logged 36 new highs, the Dow Jones Industrial Average has posted 17, and the small-cap Russell 2000 has recorded 6 new highs after finally surpassing its 2021 peak.

A combination of themes is contributing to the stock market’s lengthy list of new highs, with the most notable being the artificial intelligence boom. Companies are spending hundreds of billions on infrastructure to train AI models, build data centers, and source the energy to run them all. Nvidia recently became the first company to surpass a $5 trillion market cap, and leading technology firms like Microsoft, Amazon, Alphabet, and Meta are reporting strong growth tied directly to demand for their cloud computing services. The industry’s momentum and forecasts for continued strong growth are driving AI stocks higher, and their large index weights are helping to push the broader markets to all-time highs despite narrow market leadership. To put the rally into perspective, the market-cap-weighted Russell 1000 Index is up +14% year-to-date. The equal-weight version of the index is up 6%, while the median stock has gained just 2%. Beneath the surface, nearly half of the index is in the red, with 462 companies down year to date.

While AI is getting the most attention, several other catalysts have contributed to the market’s strength. After a 9-month pause, the Federal Reserve restarted its rate-cutting cycle in September, lowering interest rates by -0.50% over the past two months. Lower borrowing costs and expectations for additional rate cuts have provided a tailwind for stocks. At the same time, the U.S. economy has remained resilient amid multiple headwinds, including trade policy and tariffs, geopolitical tensions, and a government shutdown. Corporate earnings growth remains strong, and Q3 earnings exceeded expectations.

This year has shown the value of staying invested through uncertainty. Trade tensions and policy uncertainty have created periods of market volatility, and if investors had known the headlines before the year began, they may have been tempted to sell. However, doing so would have meant missing out on the S&P 500’s nearly +15% return and long list of new highs. Timing the market is difficult and often costly, and it can lead to missed opportunities that make it challenging to meet your financial goals. Each year brings its own reminders of core financial planning principles. If 2025 underscored the importance of staying invested, 2026 may highlight the importance of portfolio diversification.

Number of New S&P 500 All-Time Highs by Calendar Year (1928-2025)

Source: S&P Global. Past performance does not ensure future results. Time Period: January 1928 to November 2025. Data as of 11/15/2025.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.