Stocks Hit New Highs as Market Navigates Shutdown, Fed Policy, and AI Spending

Photo Credit: Ruvim Noga, Unsplash

Monthly Market Summary

The S&P 500 Index rose +2.3% in October, bringing its year-to-date return to +17.5%. Large Cap Growth stocks gained +3.6% and outperformed the index, while Large Cap Value returned +0.4%. Major stock indices set new highs, with the S&P 500, Dow Jones, Nasdaq 100, and Russell 2000 all posting a sixth straight month of gains.

Technology led all S&P 500 sectors, with the Nasdaq 100 gaining +4.8%. Health Care and Consumer Discretionary also outperformed the index, while the remaining eight sectors underperformed, with five sectors trading lower.

Bonds traded higher as Treasury yields ended lower despite intra-month volatility. The US Bond Aggregate returned +0.6%, while corporate bonds underperformed. Investment-grade delivered a +0.4% total return, and high-yield gained +0.2%.

International stocks split the S&P 500’s return. Developed Markets gained +1.2%, underperforming the S&P 500, while Emerging Markets returned +4.2%.

Federal Reserve Cuts Interest Rates as Government Shutdown Drags On

The government shutdown that began on October 1st remains unresolved as of month-end, officially becoming the second-longest in US history, behind the 2018 shutdown. The shutdown, which is due to partisan gridlock over federal spending and health care subsidies, has disrupted government operations and caused hardship for federal workers. The market has largely dismissed the stalemate as political noise, but the shutdown's length is starting to raise concerns about its impact on consumer sentiment and business activity.

The shutdown has complicated the interest rate policy by halting the release of economic data. Federal Reserve policymakers have had to make decisions without the latest data on the labor market, consumer spending, and housing market. Despite the data blackout, the Fed cut rates by -0.25% in October, its second consecutive rate cut. The decision reflects growing concern about a softening labor market, with Chair Powell emphasizing that employment risks have overtaken inflation risks, despite inflation remaining above the 2% target. The market expects another 0.25% rate cut in December, although the probability fell after Powell said a rate cut is “not a foregone conclusion.”

Stocks Trade Near All-Time Highs Despite Credit Concerns & Trade Tensions

Stocks ended October near all-time highs after they staged a late-month recovery. Credit concerns surfaced early in the month after multiple regional banks disclosed losses tied to commercial real estate fraud. The news came only weeks after two high-profile bankruptcies in the auto sector, reigniting concerns about credit quality. Stocks initially sold off, but by month-end, concerns eased as credit rating agencies and analysts characterized the issues as isolated rather than systemic.

Around the same time, a sudden re-escalation of US–China trade tensions rattled the market just weeks before a high-stakes Trump-Xi summit. It began when China expanded export restrictions on rare earth minerals, prompting the White House to threaten a 100% tariff on all Chinese imports if Beijing didn’t reverse course. The threats sparked a stock market sell-off and revived fears of a trade war. However, despite the harsh rhetoric and threats, both sides left room for negotiation. The Trump-Xi summit took place as scheduled in late October, and the meeting yielded several headline agreements that helped ease near-term US-China trade tensions.

Market Sentiment: Cautious Optimism Ahead of Year-End

Market sentiment is cautiously optimistic heading into the final two months of the year, supported by the Fed’s rate-cutting cycle, continued enthusiasm around AI, and solid Q3 corporate earnings. November and December are historically strong for equities, and while investors are bullish, they’re not euphoric. Despite credit concerns fading and trade tensions easing, other risks remain. Valuations are elevated, investors are questioning the return from AI infrastructure spending, and job growth has slowed in recent months. Chair Powell’s pushback against a December rate cut tempered some enthusiasm, but hopes for a year-end market rally remain intact, even as attention shifts to 2026.

US Market Sector Returns (October in %)

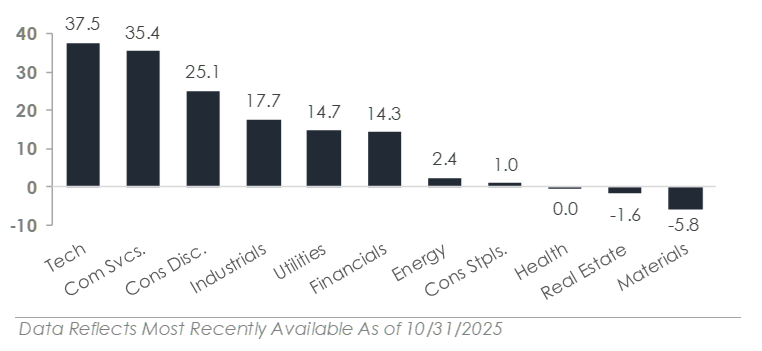

US Market Sector Returns (YTD in %)

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.